Learn How To Trade S&P Futures & Stocks

Learn to take your day and swing trading to the next level with my video course where I will teach you 5 new trading strategies.

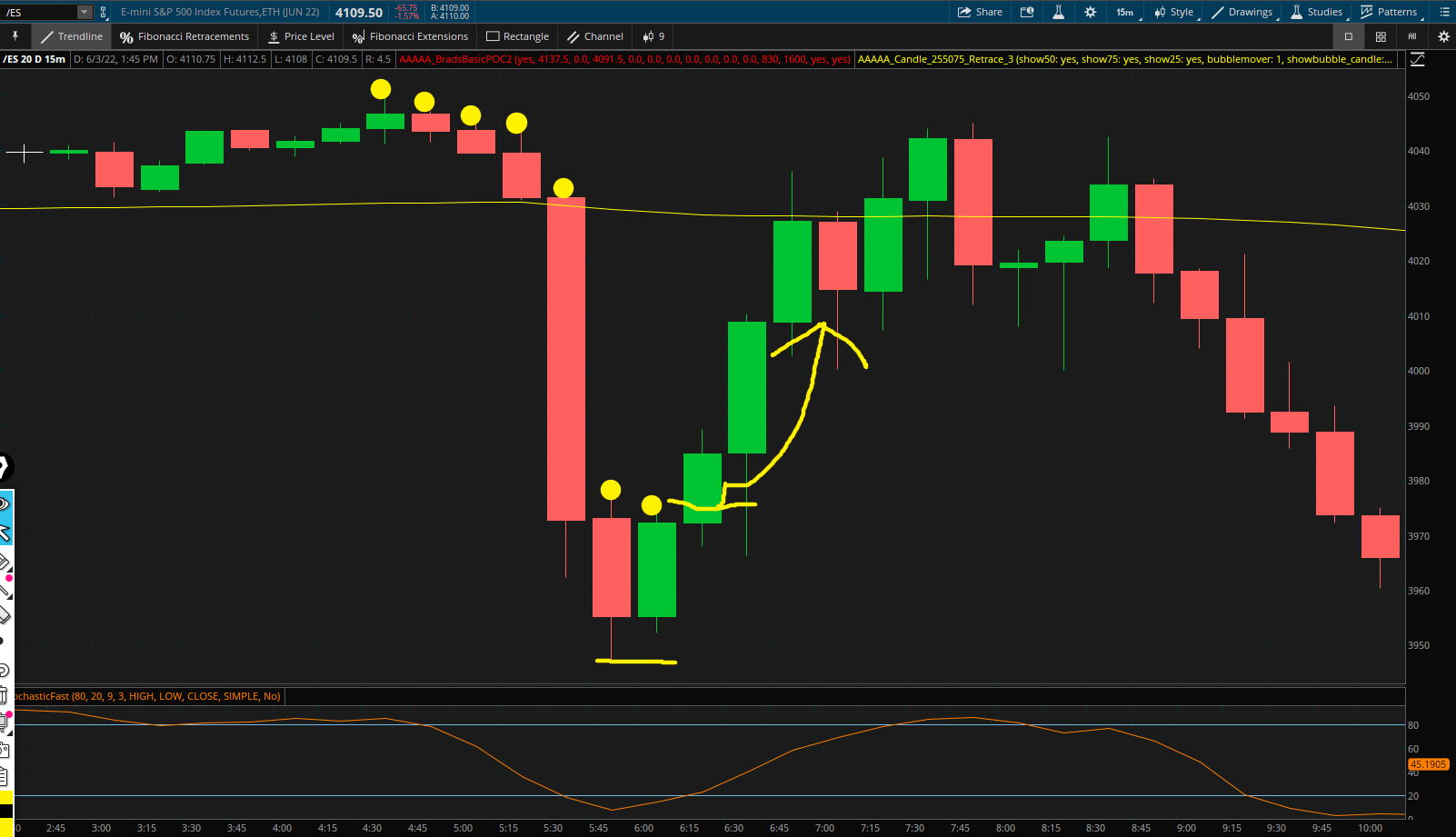

Learn Supply & Demand Trade Zones

As part of my Top 5 Trading Strategies video course you will get 3 hours of education on how to draw supply & demand trade zones.

Top 5 Trading Strategies Video Course

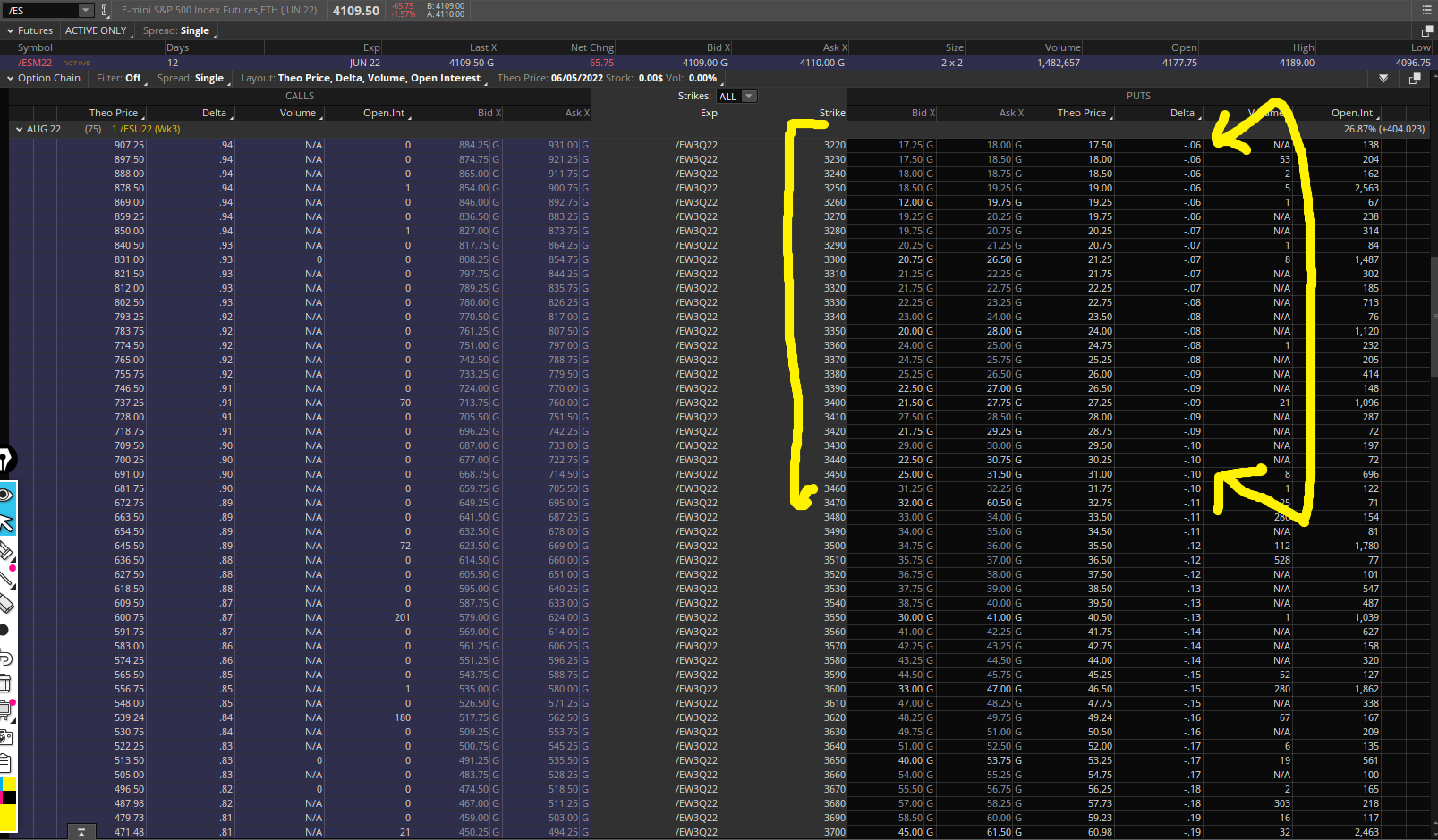

Get 8 hours of trading educational videos where I teach you my Top 5 Trading Strategies for trading the stock, options & future markets.

You Will Learn These

5 Trading Strategies

Learn how to draw supply & demand trade zones, price action trading, divergence setups, fibonacci strategy and selling puts for income.