The “Supply & Demand Weekly Trade Zones” are Trading Levels updated every weekend for the S&P 500 E-mini Futures.

These Trading Zones are good for the day or weeks trading and are trading levels where price could reverse its direction.

Which Futures are included with the “S&P 500 E-mini Supply & Demand Trade Zones” ?

What You Will Get with the Weekly S&P 500 E-mini Trade Zones in the Members Section:

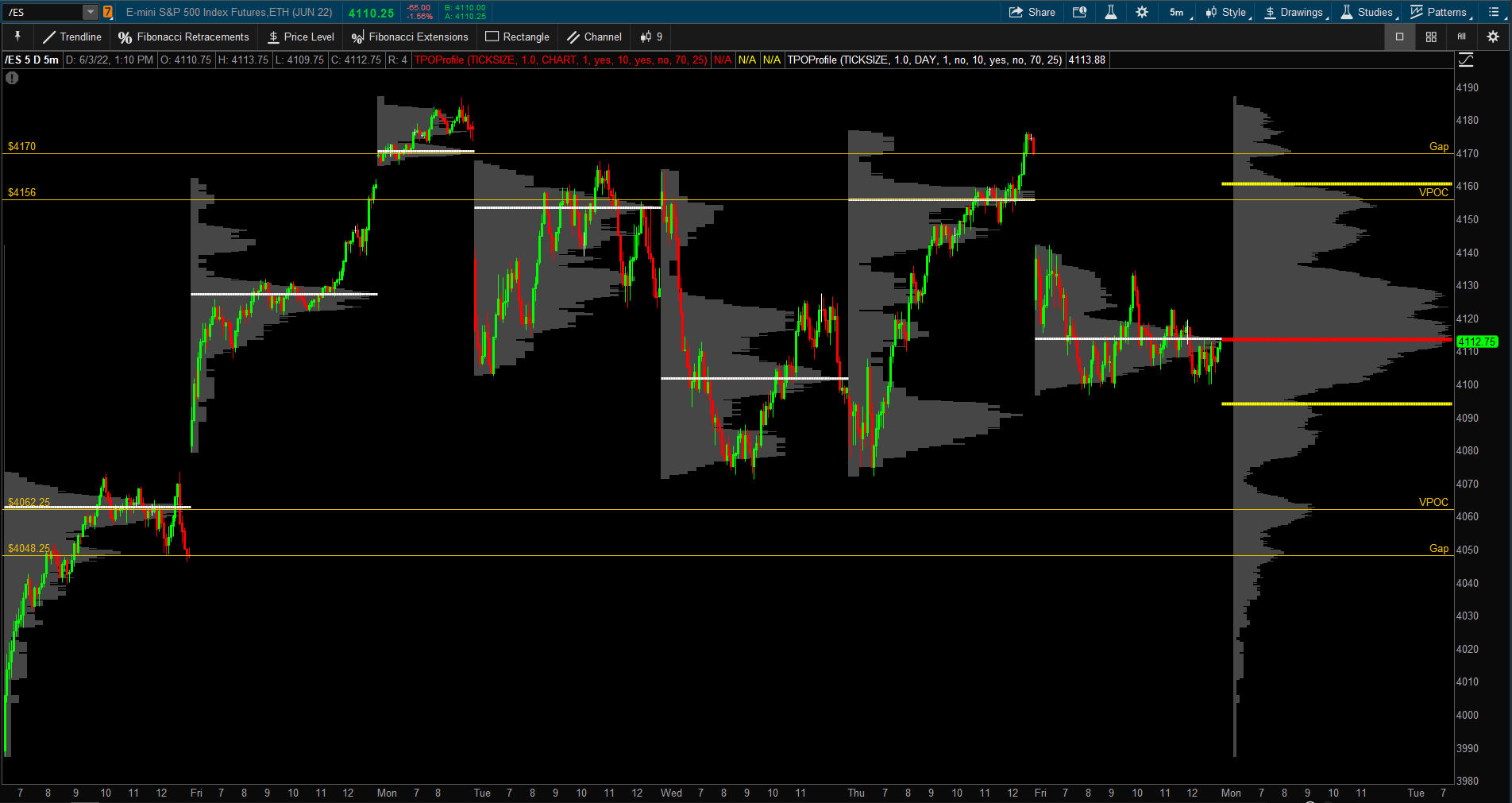

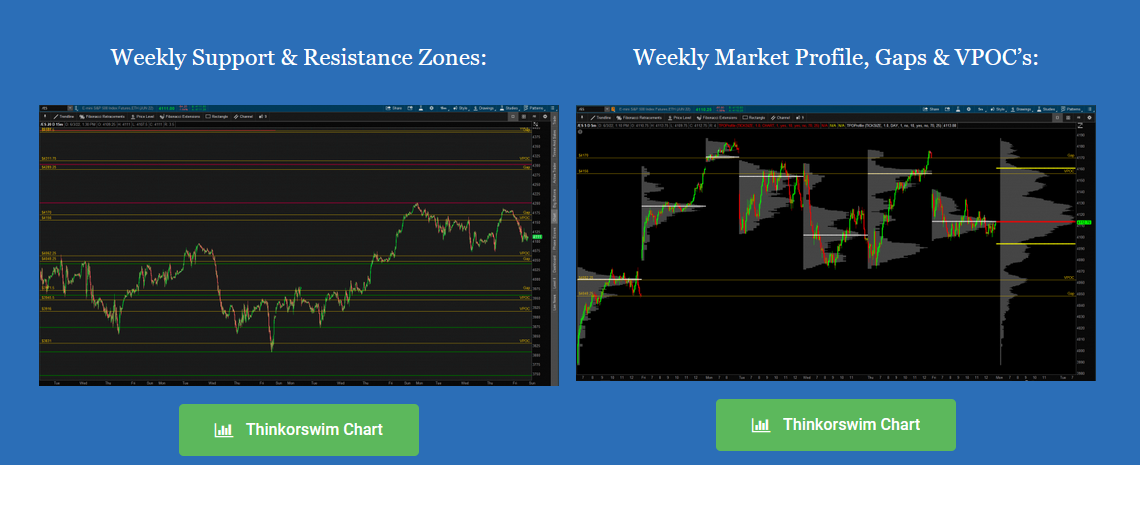

You will get 2 charts for the S&P 500 E-mini Futures showing the upcoming weeks Supply & Demand and Market Profile with current Open Gaps & Naked VPOC’s that you can visually see. You also get access to the 8 Hour Top 5 Trading Strategies Video Course that will teach you the secrets on how to draw your own trade zones on any stock, futures or crypto trading chart and also how to trade them with risk vs reward.

You will also get the Support and Resistance Trade Zones written out so you can use them with any charting software. Finally if you are a Thinkorswim user we have added a share button so you can download the Weekly Supply & Demand Trade Zones directly to your TOS trading charts.

I post the Weekly Trade Zones every Sunday evening by 6pm Est. in the members section. Just login to the members section to access the Weekly Trade Zones and Charts to get ready for the current trading week.

Trade levels to help you identify support and resistance that you can use to day trade or swing trade the S&P E-mini Futures or SPY.

If you are a day trader or swing trader you can use our trade zones for either big or small moves to trade and make money.

Included is a 8 Hour top strategies trading video course on how to draw the trade zones and also how to trade them so you can draw your own zones.

In the video course you will learn how to draw the trade zones (Support & Resistance Levels) on any stock, futures or crypto chart.

They are levels of support and resistance for the S&P Emini Futures.

The weekly trade zones are meant to be levels of support and resistance and how much the S&P emini’s reverse varies. Some times they will bounce for a couple points and other times they can have major reversals.

Note: Not all zones will work that’s why we encourage you to always use a stop loss. A good rule of thumb is to put a stop loss 1 point behind the trade zone. (We want to either be right on the trade, or right out of the trade).

The S&P emini futures weekly trade zones are updated by 6pm EST Sunday evening. Just login to the members section for all the trade zones and charts.

Yes, you can use any trading platform or charting package. We give you all the top 4 support and resistance trading levels that you can plot on your own charts such as one of our recommended trading platforms Thinkorswim

If you use Thinkorswin (TOS) we offer links every weekend that you can open in your Thinkorswim platform and save the weekly trading zones, open gaps and naked VPOC’s to all your charts. If you do not use TOS and use another trading platform you can manually plot the levels on your charts.

It’s really just that simple….

The S&P emini futures daily & weekly trade zones with the open gaps and naked vpoc’s come with the my top 5 trading strategies video course 8 hours of education for a 1 time payment of only $99.

2023: DayTradingFearless.com, The content on this website is for informational and educational purposes only and is not and should not be construed as professional financial, investment, tax, or legal advice. Any use of words ” lifetime membership” means for as long as I keep the website Daytradingfearless.com active. If I ever close the website down there will be no refunds given. Trading in stocks, futures, commodities, bonds, stocks, options (and others not listed), have large potential rewards but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in these products. Do not trade with money that you cannot afford to lose. The past performance of any trading system, methodology, or particular trader is not indicative of future results. All content is provided subject to the qualifications and limitations stated in our Terms of Service. By entering Daytradingfearless.com, you agree that you have read, understand, and agree to be bound by our Terms of Service.

2023: Risk Disclosure: Futures and Forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure: Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets

© 2023 All Rights Reserved DayTradingFearless